CORPORATE VEIL INTRODUCTION

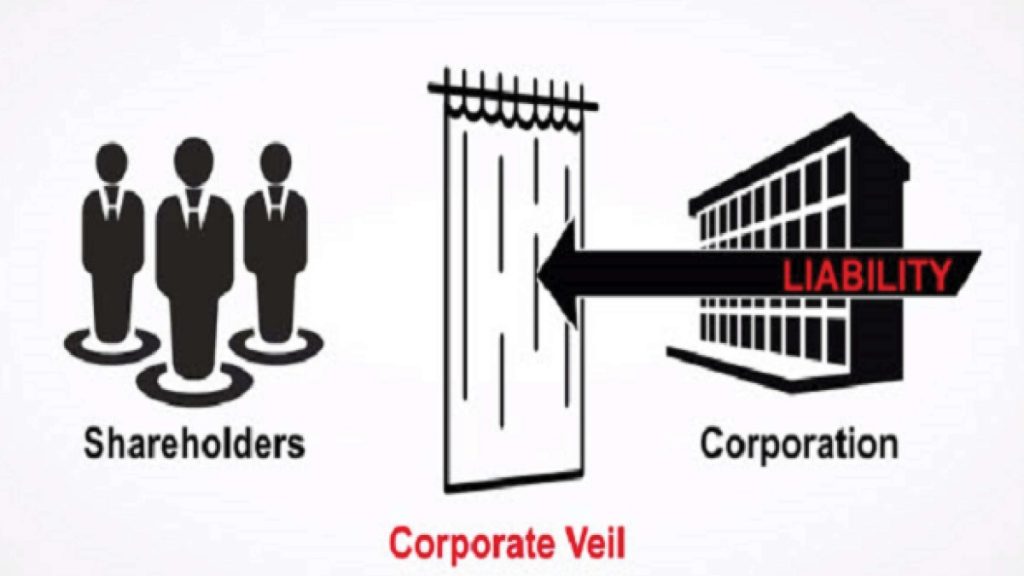

This notion of difference is referred to as the Corporate Veil, sometimes known as the “Veil Of Incorporation.” which consists of its members and is administered by its Board of Directors and its personnel. When a corporation is incorporated, it is granted the status of a separate legal entity, which distinguishes it from the members or shareholders of which it is comprised.

Lifting of Corporate veil

The Companies Act of 2013 specifies that a corporation is a different entity from its members. In reality, however, it is an organization of individuals who are the beneficial proprietors of the business and its assets. This deception is manufactured via a curtain known as the corporate veil.

Under the Companies Act of 2013, removing the corporate veil involves disregarding the fact that a corporation is a separate legal entity and has a corporate personality. The lifting of the corporate veil in accordance with the Companies Act of 2013 disregards the distinct identity of the business and focuses on the firm’s real owners.

The distinct personality is a regulatory benefit that may only be utilized for legitimate purposes. Individuals shall not be entitled to hide behind the veil of corporate identity whenever and wherever dishonest exploitation of the legal system occurs.

This company’s shell will be broken, and the individuals who have committed this offense will be sued. This is referred to as removing the Corporate Veil under The Companies Act of 2013.

The Corporate Veil is a shield that protects the company’s members from its actions. In common parlance, if a firm breaks the law or incurs liabilities, the members cannot be held responsible. Consequently, stockholders are shielded from the company’s actions.

DEVELOPMENT OF CORPORATE VEIL

Salomon vs. Salomon and Co. Ltd.

The case included claims of some unsecured creditors in the liquidation process of Salomon ltd., a firm in which Salomon was the primary shareholder; he was thus sought to be held personally accountable for the company’s debt.

The court of appeal, in declaring the company to be fictitious, reasoned that Salomon had incorporated the company contrary to the true intent of the then Companies Act of 1862, and that the company had conducted business as an agent of Salomon, who should therefore be liable for the debt incurred as a result of such action.

The House of Lords, however, reversed the above ruling on appeal, unanimously holding that, since the company was duly incorporated, it is an independent person with rights and liabilities appropriate to itself, and that “the motivations of those who participated in the promotion of the company are completely irrelevant when discussing what those rights and liabilities are.” The Salomon case firmly established the legal fiction of the “corporate veil” between the corporation and its owners/controllers.

These are the grounds for lifting the Corporate Veil:

Inaccuracy In Prospectus

In the event that a misrepresentation is made in the business’s prospectus, the company and every director, promoter, and another individual who authorized the release of the prospectus shall be responsible for compensating those who purchased shares based on the misrepresentation.

In addition, these persons may be penalized with a minimum six-month prison sentence. Its term is extendable to 10 years. The implicated firm and individual shall also be subject to a fine that shall not be less than the amount involved in the fraud and may reach three times that amount.

Misrepresentation Of Name

According to the Companies Regulation, 2014, a company’s name must appear on all official papers, including (hundis, promissory notes, bills of exchange, and such documents as may be specified).

Hence, a company official who signs a contract, BOE, Hundi, promissory note, check, or money order on behalf of the business shall be accountable to the holder if the company’s name is not correctly specified.

Fraudulent Behaviour

In the event of a company’s dissolution, it is revealed that any business was conducted with the goal to defraud creditors or any other individual or person accountable for all debts and other obligations of the firm.

It may be possible to impose liability under the fraudulent conduct statute if it can be demonstrated that the company’s business practices deceived its creditors.

Ultra-Vires Actions

Directors and other executives of a company will be held accountable for all of the ultra vires acts they have committed on the firm’s behalf.

Inability To Return Application Fees

In the case of a Public Issue, if the minimum subscription specified in the prospectus is not obtained within thirty days after the release of the prospectus or such other term as may be specified, the application money will be refunded within fifteen days of the issue’s conclusion.

Suppose, however, that a portion of the application fee is not reimbursed within the given time frame. In such a circumstance, the directors/officers of the firm will be jointly and severally responsible to pay 15% every year of the amount owed.

In addition, the defaulting corporation and its officers are responsible for a penalty of one thousand rupees every day that the default continues, or one million rupees, whichever is less.

Under Other Statues

The directors and other executives of the company may be held personally liable under the provisions of legislation other than the Companies Act of 2013. For example, under the Income-tax Act of 1962, when a private company is dissolved and if tax arrears relating to the income of any preceding year cannot be recovered, each individual who served as a director of that company during the preceding year is jointly and severally liable for payment of tax.

First, the court declined to break the veil of corporate governance on the basis of the distinct entity and district corporate persona. Due to the development of businesses and the escalating conflict between them and their many stakeholders, courts have adopted a more pragmatic approach and pierced the curtain of corporate governance.

There are several situations under which the corporate veil can be lifted and the individuals behind the business organizations can be identified and punished.

- Inappropriate conduct and Fraud Prevention

- Establishment of the Agent Subsidiary Business

- Economic Crime

- Revenue Security

- The business exploited it for unlawful purposes

- Organizations disregarding welfare regulations

- Business committing deception

Tata Engineering and Locomotive Co. Ltd. vs. State of Bihar

In this case, it was stated that a corporation is not entitled to initiate a lawsuit in the name of basic rights by identifying itself as a collection of persons who possess those rights. When a company is formed, its business is the responsibility of the incorporated body and not of the individuals that make up the company, and the privileges of such a body must be determined based on this balance and not on the assumption that they are the rights owed to the business of the individuals that make up the organization.

N.B. Finance Ltd vs. Shital Prasad

In this case, the High Court of Delhi granted the offended party organization a stay order preventing the defendant’s company from alienating the properties it owned on the grounds that the defendant fraudulently borrowed money from the plaintiff companies and purchased properties in the name of the defendant companies. In this instance, the court did not grant protection under the corporate veil-piercing doctrine.

Also, Read THE BASICS OF CONTRACTS AND AGREEMENTS

CONCLUSION

It should be remembered that the Salomon vs. Salomon & Co. Ltd. concept is still the rule, and cases of veil piercing are the exceptions. In several instances, the law and the courts have now permitted the lifting of the corporate veil. Under the Constitution of India, the notion that a firm has its own unique legal identity has an important place.

Hence, a corporation can possess and sell property, sue or be sued, and commit a crime since it is composed of and managed by persons acting as the company’s representatives. As a result of incorporation, a corporation dons a ‘corporate veil’ and gains the ‘corporate personality’ behind which stockholders have created the firm. While the business has an autonomous existence under the law, it is an artificial person; thus, behind the corporate veil, there are natural individuals, i.e. shareholders, who have joined the company. So, if this corporate personality is revealed or unmasked, shareholders or directors are typically found to be hiding behind the curtain.

Written By Rustam Ambawat Inter at Fastrack Legal Solutions