Abstract to Fractional Shares

Fractional share When viewed from above, the investing world appears to have a straightforward structure, but as we begin to understand its subtleties, we find that even seemingly insignificant changes to the game’s rules have a significant impact on how certain corporations operate and survive in this highly competitive capitalist environment.

Similar topics will be covered in this article. While they may seem like tiny adjustments to the current investing system, they have the power to alter market dynamics, investor behaviour, and even provide entirely new investment avenues. This essay will provide a general overview of potential legislative changes to the Indian stock market and how the introduction of fractional shares may impact it.

Introduction to Fractional Shares

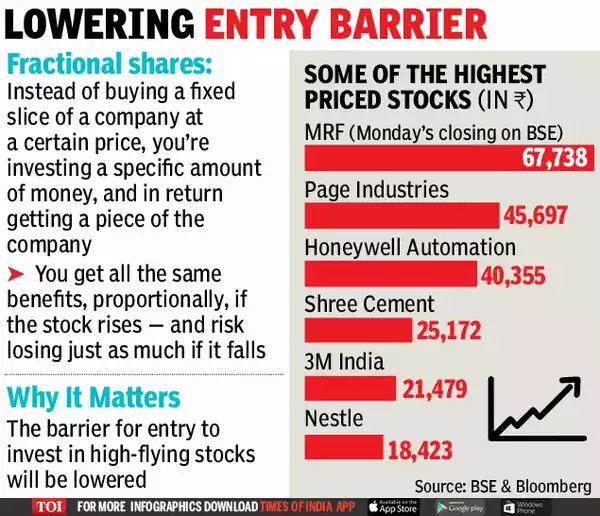

As their name suggests, fractional shares are just like regular shares, except they are offered in fractions, and the buyer can select the exact number of shares they want to buy. This suggests that an individual seeking to become involved in a company is not limited to acquiring a single full share; rather, they might choose to acquire a fraction of a share instead. The same rights and obligations apply to a buyer of a fractional share as they do to a buyer of a whole share. Due to the similarities between the two payment methods, buyers who pay with cash or credit are categorised as investors. Over time, the benefits and possible returns of stock ownership have not changed. By participating in the market, you expose yourself and all other participants to the same possible losses as the market.

In the past, buying penny stocks was occasionally the only option available to investors with little funds. These securities are issued by unidentified companies and frequently have low ratings and significant risk. Investors can still own a portion of any company that is listed on a public market, though, because fractional shares are still accessible. Because fractional shares are accessible, this is the situation. The markets have come around to accepting fractional shares, which trade for thousands of dollars a share; nevertheless, some of the biggest firms in the world, as well as in the United States, do not yet accept this form. When making this decision, it is crucial to consider not only the current cash position but also the businesses in which one has the highest level of trust on future financial performance. This keeps you from putting all of your money into a single business or sector of the economy. It also helps you build a diverse portfolio, which reduces the total risk of your investment plan. Because fractional shares are readily available, investors can invest for less money overall, potentially lowering the cost of diversification. If you had $25 and wanted to invest, you could put that money into five separate firms at $5 per, for a total of $25. By doing this, you might diversify your investments without going over your spending limit. (McNichols, 1990).

Trading fractional shares is not completely risk-free, either. Due to the low entrance barrier, prospective investors can decide not to do as much research as is required to make wise judgements. Partially investing in a firm’s stock is a riskier investment choice than buying shares of a huge corporation or investing in an index fund, but it does provide you the chance to beat the market.

If you can buy fractional shares rather than full shares, you have a better chance of choosing investments that outperform the market if you have a sound investment strategy, are willing to take the time to choose individual investments, and are willing to put in the work to build a diversified portfolio. Even if you are limited to buying entire shares, this is still the case. You should be successful if you have a sound investment plan, have the patience to choose individual stocks, and are dedicated to assembling a diverse portfolio.

This means that if you buy fractional shares, you won’t have to worry as much about the share price and can instead invest in the firms you think will do the best. (Bieber, 2022)

Should India Allow Fractional Share Investing ?

The Indian stock market may soon witness the reality of fractional share investment. The Ministry of Corporate Affairs established the Company Law Committee in 2019, and it issued its third report in April 2022 with a number of recommendations for the government to improve the ease of doing business in India and the functionality of the Limited Liability Partnership Act of 2008 and the Companies Act of 2013. The government was encouraged in the study to modify the firms Act to permit firms to issue Stock Appreciation Rights, Restricted Stock Units, and fractional shares. According to Section 4(1)(e) of the Indian Companies Act, 2013, which regulates a company’s memorandum of association, a subscriber may not split the amount of share capital that needs to be registered and divided into less than one share. As a result, businesses are practically prohibited from issuing fractional shares.

This article tries to clarify what fractional share investment is, why implementing it may benefit India, and how some other countries have handled the legal and policy issues surrounding the topic of these shareholders’ voting rights.

Laws in Foreign Jurisdictions on Fractional Share Investing

Japan, the UK, Canada, and the USA are among the nations that permit fractional share trading and ownership. As long as the company’s articles of association do not prohibit it, firms in the UK are permitted to have a fractional nominal value of their shares following share subdivision (section 618 of the UK firms Act, 2006). Corporations are permitted to issue fractional shares in Canada; however, as per section 49(17) of the Canadian Business Corporation Act, holders of these fractional shares are not entitled to dividends or voting rights unless the fractional share is the outcome of a share consolidation or the company’s articles specify otherwise. Fascinatingly, fractional shares are handled differently under Japanese company law. If fractional shares arise from a share split, consolidation, or from the stock company issuing them, the said company will auction off the number of shares equal to the total sum of the fractions and distribute the proceeds to the shareholders based on the fractions of shares they own.

Since the US originated the concept of fractional investing, it has always adopted an operationally more laissez-faire stance. Fractional share investing is permitted, and brokerage firms are granted discretion over the kinds of securities they can trade, the types of orders they can accept, trading restrictions, and how they will handle and carry out trades involving orders to buy or sell fractional shares. Although fractional share owners will not be able to directly exercise their voting rights, the US system provides for some flexibility even in this regard, granting brokerage companies the authority to determine whether or not investors may use their “proxy” voting rights.

Proxy Voting Rights on Fractional Shares and Applicability in India

Proxy voting is done on behalf of a shareholder by a single individual or entity, which is typically a brokerage or asset management company. Since proxy voting for fractional shareholders is unrestricted in the US, brokerage firms that grant proxy voting rights to fractional shareholders, such as Robinhood, will be compliant with US Securities and Exchange Commission regulations regarding transparency. These brokerage firms will aggregate the votes and report the voting results. Nonetheless, the majority of nations define shareholder rights in terms of complete shares, and even those that permit the ownership of fractional shares deny their holders the ability to vote. Nonetheless, the majority of nations define shareholder rights in terms of complete shares, and even those that permit the ownership of fractional shares deny their holders the ability to vote. In addition, the Companies Act of 2013’s section 105, which governs proxy voting in India, grants the proxies a very limited range of privileges. Taking everything into account, it is likely that voting rights would only be granted to owners who own all of their shares. A different plan may let only one fractional shareholder (as decided by the other shareholders) to cast a vote on their behalf.

Current Indian Provisions

As of right now, fractional shares cannot be bought, sold, or exchanged in accordance with Act Section 4(1)(e)(i). “The number of shares which the subscribers to the MoA agree to subscribe should not be less than one share,” the provision explicitly reads.

The Committee discussed whether to allow fractional share trading in order to facilitate the behavioural shift in the Indian retail investment segment, which is evident in the country’s rapidly increasing number of retail investors. Section 49(17) of the Canada Business Corporation Act, 1985, which provides for the rights of fractional shareholders, is one of the domestic and foreign practices that the CLC became aware of.5, Japan (fractional shares are treated under Article 234 of the Companies Act, 2005)6, and the United States (the US Securities and Exchange Commission Bulletin, 2020 informs investors of the nature, advantages, and other rights and responsibilities related to trading and investing in fractional shares). It also acknowledged the National Stock Exchange’s (NSE-IFSCs) decision to permit trading in fractional shares of international equities within its regulatory sandbox in India.8 NSE CEO Mr Vikram Limaye praised the action, calling it a “key milestone” for the nation’s stock market.9…

The Committee proposed that dealings with fractional shares only take place in dematerialized form and should be permitted for the new issuing of such shares after considering the experiences in different jurisdictions. Shares that have already been established as a result of business acts like mergers or amalgamations, etc., should not be covered by them. It is also recommended that clauses enabling fractional share trading for listed businesses only be specified following SEBI consultation.

Major Argument

One of the main points of contention is that companies that want to draw in investors who are willing to invest small sums of money or low-priced stocks on a regular basis attempt to split their stock in order to lower the stock’s single price, which ultimately resolves the issue when the token size of one stock is lowered. For businesses at this stages, when they choose what sort of investors to invite on their own, this technique is relatively doable. It is evident that certain firms have extremely high stock prices while having a little market capitalization. Conversely, there are corporations with extremely low stock prices but large market capitalizations. This is the current state of affairs in India, and maybe impending legislation will bring a fractional share structure, which would alter the current dynamics.

Also Read Starting a New Business: The Importance of Legal Considerations and Fastrack Legal Solutions 2023

Problem of Penny

In the United States, investors usually work with well-known discount brokers who can make it easier for them to acquire high-risk assets. A company’s stakes in micro-cap companies have a market capitalization that is even more low than those of penny stocks. The prices of micro-cap stocks typically range from $50 million to $300 million. For a firm to qualify as a nano-cap, its market capitalization must be less than $50 million. Any stock that is not publicly listed and trades for less than $4 is referred to as “penny stock,” according to the Securities and Exchange Commission (SEC). The OTCBB offers penny stocks for sale on both the pink sheets and the OTC bulletin boards.

Only sizable brokerages are permitted to receive your fractional share for sale; the brokerage will then combine it with the fractional shares of other investors to form a complete share. If there isn’t much demand in the stock that’s currently being offered on the market, it’s feasible that selling the fractional shares may take longer than anticipated. Some investors could decide not to hang onto the fractional shares they inadvertently obtained during a corporate split.

At any given moment, an investor may own 225 shares of $12 XYZ stock in their hands. Following a 3 for 2 stock split, 33712 shares would be issued at a price of $8 each. Finding a brokerage company that is prepared to accept the partial investment will be easier if the XYZ stock is trading actively. They could be able to grow their holding to 338 shares, which would be a substantial increase, if they can locate a broker who is prepared to sell one additional half share.

The first misconception is that huge businesses like Microsoft (MSFT), Walmart (WMT), and others started out as penny stocks and eventually gained significant value. This is a mistake made by investors who concentrate on the adjusted stock price. Stock splits are included in this pricing. Although split-adjusted prices for Microsoft and Walmart were $0.08 and $0.01, respectively, their opening prices were $21 and $16.50. These companies had lofty beginnings and steadily increased in size until they required division. Penny stocks give investors the chance to expand their holdings and diversify their portfolios. You will profit by 50% if a stock you purchase for $0.10 increases by $0.05. This, together with the fact that $1,000 may purchase 10,000 shares, persuades investors that investing in micro-cap firms is a quick and reliable method to increase profits.Sadly, investors in penny stocks tend to overlook the disadvantages. It’s rare for these stocks to prosper, and you might lose money.

Even yet, it should be understood that a company’s ability to develop is dependent on its market value, not its stock price. Companies with higher stock prices and lower market capitalization have greater room to grow than those with lower stock prices and larger market capitalization. Individuals continue to purchase lower-priced firms with the intention of making more money and using these companies as bait in the illusion of declining stock prices. However, it is precarious to argue that the introduction of fractional shares will solve the issue because investors in penny stocks will still do so because they will continue to see the stock price of the company while ignoring the fact that they can now purchase a portion of stock in which they can invest any amount of money they choose.

Benefits of Fractional Sharing

In the modern period of investing, we have seen a multiplication in the accessibility of the stock market. The traditional perception of investing in the stock market was that of investors calling you on your cell phone with a tip and buying on your behalf with no record of it; you had to trust the people on the other end. However, these days, platforms like UpStocks, Zerodha, and others have made it possible for the stock market to be accessible to everyone and have significantly increased system transparency.

When individuals have more possibilities to participate in major stock firms with a huge market cap at prices that small investors want to pay, fractional share concepts make portfolio diversification more easier. The next generation of investors will be able to diversify their portfolios in line with this. If an investor wants to invest a specific amount directly in stocks, this idea will also assist them in making equal monthly investments in the stock market. This will help the market as a whole since investors who make these kinds of investments are more inclined to stay for a longer length of time in order to receive larger returns.

Drawbacks

One of the main issues with the system is that whenever it is implemented in a new market, regulators often try to strike a compromise in order to appease investors and businesses. As a result, laws are often created that allow businesses to choose whether or not to trade in fractional shares, completely negating the benefits that have been discussed. By selecting the calibre of investors based on their capital, this is also done to preserve market stability.

Although fractional shares appear to boost market liquidity, in practice it is exceedingly difficult to locate another buyer willing to purchase an equivalent number of shares when sellers want to transmit a specific quantity. While it is possible to correct this mismatch by making certain technical adjustments to the purchase and sale of stocks, investors may occasionally struggle to find a buyer. The way in which you invest in a firm will determine your rights as a shareholder, and this can also have an impact on shareholder rights.

Conclusion

Fractional shares will soon be available in India, but before we provide this new avenue for investing in the country, there are a few important lessons to learn. Regulators should acknowledge that although Indian markets are transparent, there are several examples of pump and dump stocks, in which novice and small investors lose a significant amount of money when greedy traders attempt to manage the stocks.

If fractional shares are introduced and regulated in a way that takes into account all the benefits and drawbacks of fractional investment, they might prove to be a game-changer for the Indian market. The idea of fractional shares gives market participants the freedom to participate in a variety of company . But it might also result in a troublesome scenario when tiny investors find themselves ensnared. Given the dynamic nature of the market, regulators ought to provide a better way to address the issue that investors are facing with the previously mentioned disadvantages of fractional investment.

Submitted By : Shivam Chopra