Table of Contents

ABSTRACT TO ONLINE GAMING

India’s online gaming market is expanding quickly, and the number of users is rising constantly. Notwithstanding its widespread appeal and prospects for growth, the sector encounters a noteworthy obstacle due to a newly suggested resolution by the Goods and Services Tax (GST) Council.1 The ruling states that online gaming will now be included under the GST framework alongside betting and gambling operations, and would be subject to a high tax burden of 28%. This article explores the potential effects of this tax categorization, including how it can hinder industrial growth, reduce its competitiveness, and affect the environment of related industries more broadly. The essay also looks at the constitutional and moral justifications for this taxing strategy, determining if it conforms to accepted legal norms or runs the danger of having unforeseen repercussions. Achieving a sustainable growth in the gaming business in India requires striking a balance between regulation, taxes, and skill-based promotion.

THE PRESENT TAX SYSTEM WITH REFRENCE TO THE PROPOSED TAX REGIMES

The goal of the planned GST implementation is to incorporate online gaming within the list of exclusions specified in Schedule III, Clause 6 of the CGST Act, 2017. Except for lotteries, betting, and gambling, Schedule III currently declares that no actionable claims are subject to GST. The GST Council’s decision suggests that Clause 6 be amended to expand the scope of exceptions and levy GST upon the pot value in online games, where the pot value refers to the entire amount paid to enter the contest, since online gaming also falls within the purview of an actionable claim.

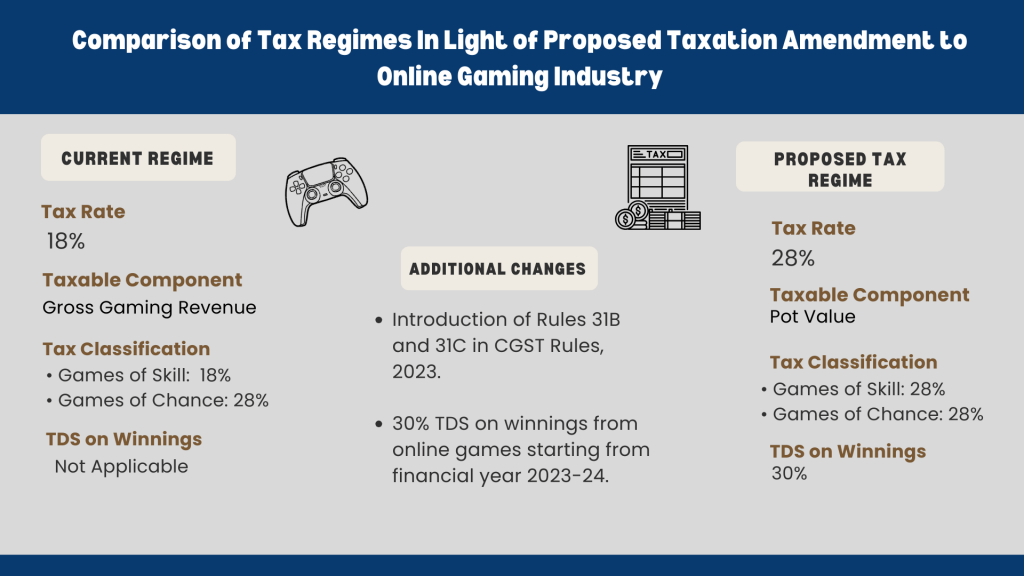

There is a distinction between games of skill and games of chance under the existing GST scheme. The tax rate on the former is 18%, whilst the tax rate on the latter is 28%. Currently, the 18% tax only applies to the Gross Gaming Revenue (GGR), which is the difference between the amount gambled and the amount won, or the platform’s service charge. Hence, GGR describes the cost imposed by an online gaming platform to enable player involvement in the game. The GST Council has suggested, nonetheless, that the pot value be subject to this higher tax rate. The Central Goods and Services Tax (Third Amendment) Rules, 2023 now include Rules 31B and 31C, which state that the value of the supply of online gaming and actionable claims in the case of casinos shall be the total amount paid by the player. The CBIC made this recommendation in Notification No. 45/2023. In essence, this means that taxes will now be based on the value of marijuana rather than the GGR as is the case now.

Furthermore, under Section 194BA of the Income Tax Act, 1961, the 2023 Budget has made it easier to impose a 30% tax deduction at source (TDS) on the entire wins from online gaming starting in the fiscal year 2023–2024. The Central Board of Direct Taxes has released guidelines for the same (CBDT). As a result, the online gambling business is currently subject to a significant tax burden.

IMPACT OF THE PROPOSAL: INDUSTRY STIFLING?

Since internet gaming is essentially betting and gambling, the GST council has classified it in the same category as horse racing and casinos. These activities, which are mostly games of chance, are subject to a 28% GST charge. Regarding this, it is important to know that the Supreme Court has recognized the element of chance in card-shuffling and dealing games because the distribution of cards depends on how the cards are shuffled in the deck. This is based on the principle of skill versus chance.

Nevertheless, even with this built-in element of luck, games like rummy demand a good deal of ability to create a plan for keeping and discarding the cards. Consequently, this kind of game is mostly a skill game rather than a game of pure chance. Applying this logic to the current situation, it is argued that as online gaming primarily entails the exhibition of a player’s knowledge, ability, and competence, the “predominant” or “substantial” character of the game should be taken into account when imposing a tax.

In this context, one may consult a number of court rulings that have emphasized particular aspects and distinguished between games of “skill” and “chance.” It has been ruled that in order to escape the stigma associated with gambling, a significant level of skill practice is required. In the seminal decision of K.R. Lakshmanan v. State of T.N., the Apex Court expanded upon this body of precedent by defining a game of chance as one in which the outcome is determined, either wholly or partially, by chance. On the other hand, the main factors influencing a game of skill are the player’s “superior knowledge, training, attention, experience, and adroitness.”

As a result, in games of chance, winning is decided solely by chance; the player cannot affect the outcome of the game with his or her physical or mental competence. A game of skill, on the other hand, is mostly decided by the player’s “superior knowledge, training, attention, experience, and adroitness.” As a result, in games of chance, the player cannot use mental or physical talent to affect the outcome of the game; instead, victory is solely dependent on luck.

Tax administrators have attempted to classify online gambling as a game of chance due to the gaming industry’s explosive growth, but this has been explicitly rejected by the courts on several occasions. In Varun Gumber v. UT of Chandigarh, the Punjab and Haryana High Court categorized fantasy sports and organized online gaming contests as games of skill, based on the distinction between games of skill and chance.

It has been noted that a player’s focus, discernment, and better understanding are what decide their success in games like Dream11’s fantasy sports. It’s interesting to note that a Supreme Court review court maintained Dream11’s definition of fantasy sports as a game of skill and dismissed an SLP challenging the Punjab and Haryana High Court’s ruling. In a similar spirit, the Bombay High Court confirmed that fantasy gaming did not contain any aspects of betting or gambling in Gurdeep Singh Sachar v. Union of India2 by using the guidelines established by the Apex Court about the differentiation between skill and chance.

Furthermore, because card games like rummy and poker require a lot of memory, the ability to calculate percentages, the need to follow the cards on the table, and other factors, the Madras High Court has recognized them as games of skill. Similar views have also been expressed by the Karnataka High Court, which decided that card games like rummy would be regarded as games of skill whether they were played in person or online. The Karnataka High Court Single Judge’s ruling and decision, which found, among other things, that online games played on Gamekraft’s platforms are not taxed as betting or gambling, has been placed on a temporary hold by the Supreme Court. The law in this respect is still up for debate because the Special Leave Petitions against these High Court rulings are still pending before the Apex Court.

Fantasy sports are now seen as games of skill on a worldwide scale, as opposed to just games of chance. US courts have ruled that because the player’s ability to choose a team affects the outcome, online fantasy sports should be regarded as games of skill. As a result, given the previously listed examples, it is clear that online gaming is characterized by “skill.” As a result, the GST Council’s recent decision to classify Internet gaming as gambling and betting directly conflicts with established national and international legal standards.

The legal implications of this idea for the field of taxes need to be taken into account at this time. After sixty years of jurisprudence, the legal community has established a clear view about the distinction between games of skill and chance. As a result, the strategy of classifying online gaming with betting and gambling may cause cases to be reopened or revalued, and it may also expose the established legal precedent surrounding the gaming sector to court examination and scrutiny. Even though the modification was intended to be clarifying rather than retroactive in nature, news reports suggest that the CBIC has been evaluating online gambling businesses’ outstanding tax obligations since 2017 based on the 28% tax on GGR rather than the previous 18% tax. Reassessments of this kind and the imposition of the new tax rate on previous activities might result in needless litigation as well as heavy penalties for nonpayment in the form of interest.

Even though clarifying amendments are often retrospective in nature, they have drawn criticism since their retroactive application may raise questions about the obligations and rights of parties. Beyond what is specifically stated, the legislation does not intend to provide retrospectivity. Consequently, the assumption that a taxation law imposing liability is not retroactive in character governs it. In a recent ruling in Sree Sankaracharya University of Sanskrit & Ors. v. Dr. Manu & Anr., the Supreme Court established some guidelines regarding the retrospectivity of clarificatory amendments. It concluded that the law that was previously amended could only be applied retroactively if it was unclear or vague. The clarifying amendment must be implemented prospectively if it is a substantive alteration that modifies the law.

This ruling by the Apex Court calls for a reevaluation of the retrospective assessment of online gambling enterprises’ outstanding tax liabilities. This is logical given that the amendment significantly altered the law by putting new obligations on the public rather than just explaining the prior legislation, by raising the tax rate and basing it on the value of marijuana rather than just the GGR. Furthermore, if these changes were implemented retroactively, the gaming industry as a whole would suffer greatly as it would have a substantial negative impact on the profitability of the industry’s businesses. In light of the explosive expansion and expected future of the online gaming business, this specific method seems counterintuitive.

- Higher Tax levy

As mentioned earlier, instead of imposing an 18% tax just on the GGR, the proposed GST system imposes a 28% tax incidence on the pot value. Due to two reasons, there is a rise in the real tax value (18% to 28%) and a bigger amount being taxed (pot value rather than GGR), which results in an increased tax burden. Players would surely be forced to pay the higher tax since, if the platform had to pay the whole amount due, the platform charge would be less than the amount of GST owed, making the company unprofitable. The players would thus be subject to a significant tax burden as a result of this change in the tax framework.

- Impact on the Overall Industry

With a user base of 180 million, the Indian gambling business is one that is expanding quickly, now valued at $2.6 billion. It also has the world’s largest fantasy sports market. Over $2.5 billion has been spent by both international and domestic investors in the Indian gaming business, which has given rise to three unicorns: Dream Sports, Games24x7, and MPL.

But the recent implementation of a new tax system for online gambling might hinder the sector’s expansion. Because of its harsh tax laws, players may choose to use online gaming services offered by nations with more benevolent tax and regulatory policies, reducing India’s competitiveness in the global gaming industry.

Online gaming platforms depend on services provided by related industries like FinTech (financial technology) and RegTech (Regulatory Technology), and their decisions may have an impact on these industries. While the latter offers services that assist in fulfilling regulatory obligations, the former helps to facilitate the user’s financial transactions. A declining user base might arise from online gaming providers’ rising tax responsibility, which is then passed on to customers. This downturn can also negatively affect the FinTech and RegTech companies by lowering the clients for these services. Experts expect a possible revenue cut of 10% to 25%, even if the precise user share in this industry is yet unknown. But after the higher tax is implemented, the true effect can be determined.

Additionally, the tax imposed has a major impact on market expansion, particularly in the highly competitive online gambling sector where players may simply switch between gaming operators according to how profitable the game is. In this sense, a larger tax burden on the participants directly influences this choice. It is evident from a jurisdictional analysis that the norm is to tax GGR alone, rather than the total stake.

Currently, a number of nations, including the US, UK, and EU, solely impose taxes based on GGR. France used to impose gambling taxes on the entire turnover or pot value, but it has since changed to imposing taxes only on gross gaming revenue (GGR) after realizing that the earlier approach had unfavorable effects, including business relocation to illicit markets, revenue loss, and non-compliance with licensing and regulatory requirements. The Senate said that the previous tax system was extremely onerous and hindered the market’s ability to expand in a balanced manner. As a result, the business benefits more from the adoption of this well recognized model as it gives Indian gaming platforms a stronger competitive edge in the international market.

Furthermore, a number of platforms are currently investigating the possibility of moving abroad to circumvent the unfavorable legislative framework that has been established for online gambling. Due to the high tax incidence, the new tax charge makes the climate unfriendly for casino operators and might cause businesses to leave India. Operators who may consider submitting an application for a license to operate in the online gambling sector are impacted by the taxation level.

For example, taxes on pot values in Poland and Portugal are 12% and 8%, respectively, which has discouraged the entry of legal gaming businesses and enabled offshore betting. Regarding Poland, the growing activities of unlicensed operators have led to the gray market capturing about sixty percent of the country’s online gaming sector. One of the primary reasons Polish gambling companies have been unable to compete with offshore operators who face comparatively lower fiscal constraints and operate in a more favorable climate is the 12% turnover tax, which has frequently been criticized. Similarly, as over 75% of its online gamblers play outside of Portugal’s authorized online market, the European Gaming & Betting Association has encouraged Portuguese authorities to reconsider the taxation system and implement a taxation upon GGR model. These nations’ experiences suggest that such a paradigm is detrimental to the expansion and maximization of the market. However, the strategy adopted by the USA and other European markets shows that a tax on the GGR not only raises tax revenue but also makes the market more attractive and sustainable. In order to maintain the gaming sector, such a step would lessen offshore gambling while meeting the demands and expectations of both operators and players.

- Reviewing the Move

According to the Finance Minister, a 28% tax on internet gambling will take effect on October 1, 2023, and will be reviewed six months after that date. The full impact of the high tax incidence on online gaming will therefore be revealed over the next six months, and if experts’ predictions come to pass, the online gaming industry’s near future appears to be dismal. Furthermore, this action is not good for the business since unpredictable regulations may discourage foreign investments in the gaming sector, even in the event that the 28% tax is rolled back.

THE CONSTITUTIONALITY OF THE MOVE

The legislation may be ignoring the distinction between games of skill and games of chance. The inclusion of online gaming and gambling under the same tax category suggests the same treatment of organizations that are not always equivalent. Treating different entities equally may give rise to questions about whether Article 14 of the Constitution has been violated, making the alteration unlawful. Since the equating of the two types of distinct games would lead to the disregard of the understandable differences between these things, it may be considered arbitrary.

It is interesting that arguments arguing that online card games might not fit the requirements to be regarded as a game of skill rather than chance have been brought before the Andhra Pradesh High Court. This is due to a number of factors, including the online mode’s increased ability to foster player cooperation and the dealer’s lack of transparency when shuffling cards, both of which increase the likelihood of manipulation. Additionally, participants of real card games like rummy would become accustomed to the unpredictable nature of the game by keeping track of the cards they chose and discarded, while players of virtual card games are given a certain period of time to pick up and discard their cards; if they don’t, their card would be lost. The argument that online card games are more about luck than ability has also been made in favor of these arguments. Furthermore, online card games do not provide players with the opportunity to observe other players’ reactions in order to gauge the game’s flow and adjust their strategy, thus failing to meet the Supreme Court’s requirement for “superior knowledge” in games of skill.

Nevertheless, rebuttals to the aforementioned claims have been made, asserting that players must memorize the cards in order to keep or discard them in online card games. Some security precautions used on online card gaming platforms were emphasized in response to the notion that the online mode may encourage collusion and manipulation. These include randomly assigning players to tables so that they have no control over which players they sit at or which table they choose, encrypting the details of the playing cards so that only the player can access them and no third party can view them. They also prevent players who are logged in from the same IP address or who are in close proximity to one another from being seated at the same table. Moreover, it was argued that different platforms do, in fact, provide players enough time to consider their options and discard cards, refuting the notion that online card games could be considered games due to their lack of play time.

CONCLUSION

Given how quickly the digital and virtual worlds are expanding, it makes sense to fully embrace technology. “The gaming market is huge internationally and the number of youth connected to this market globally is increasing,” the Indian government has acknowledged and highlighted , online gaming . Technology cannot be seen in a vacuum if the game industry and the economy are to reach their maximum potential. The industry may become economically unviable as a result of the GST Council’s decision. Additionally, any change to the GST legislation would need to pass muster with the Constitution, which would include resolving the legal dispute over whether playing online card games requires more skill or luck. Consequently, it will also be discussed if making this change will eliminate the contrast between games of skill and chance. Lastly, it’s important to keep in mind that the uniform tax, which would be regarded the same as games of chance for taxation reasons, would discourage players from playing games of skill.

Submitted By:

Shivam Chopra Intern At Fastrack Legal Solutions